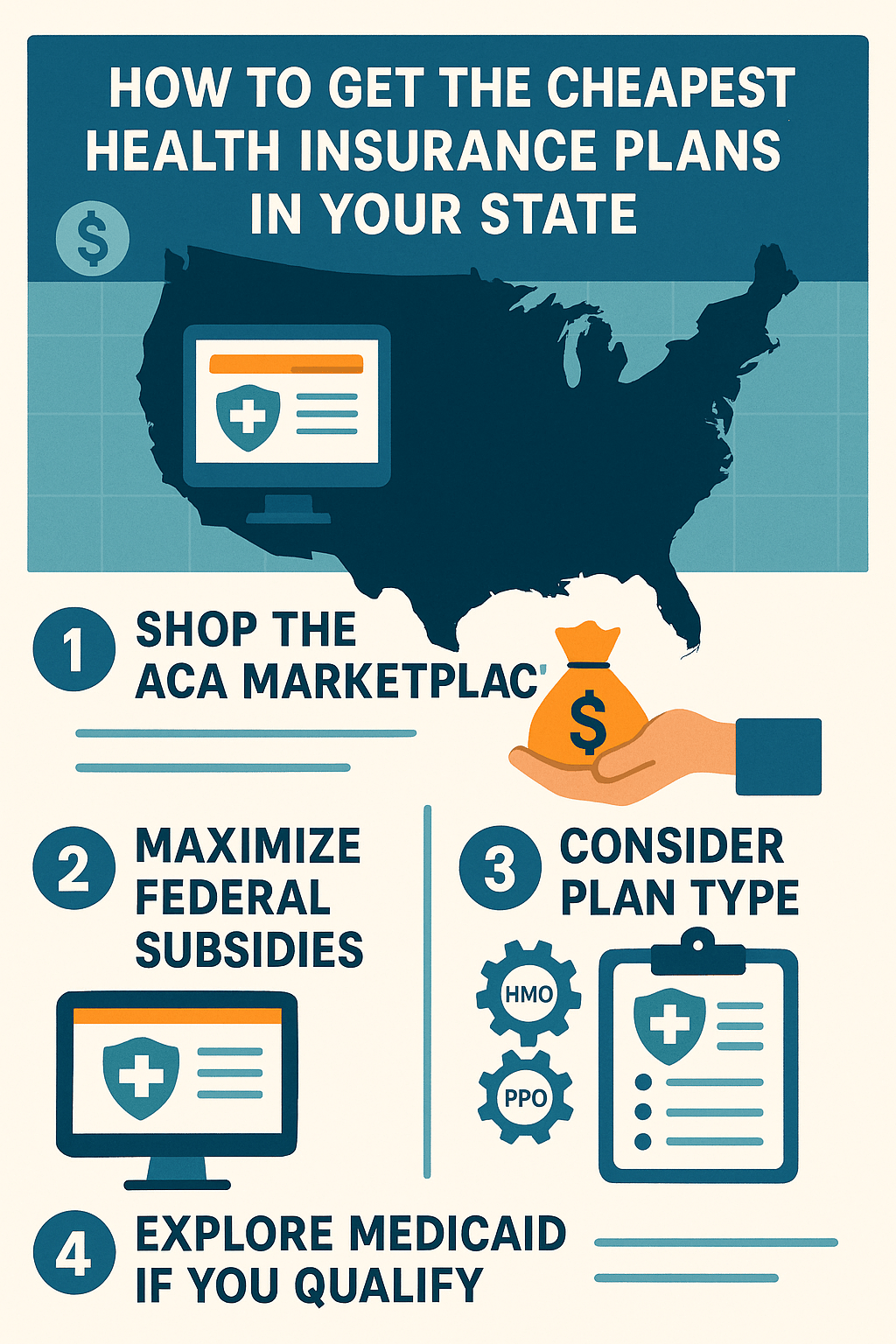

Health insurance is a major expense for many Americans, but there are ways to reduce costs without sacrificing essential coverage. In 2025, the U.S. health insurance marketplace offers more choices than ever before. Here’s how to find the most affordable health insurance plans available in your state.

1. Start with the Health Insurance Marketplace

Visit HealthCare.gov or your state’s marketplace to compare ACA-compliant plans. The platform allows you to evaluate premiums, deductibles, and out-of-pocket limits based on your income and family size.

2. Check Eligibility for Premium Subsidies

Most people qualify for premium tax credits and cost-sharing reductions based on income. These subsidies can drastically lower monthly premiums and deductibles, especially for low- to moderate-income individuals.

3. Choose the Right Type of Plan

Understand the differences between HMO, PPO, EPO, and POS plans. HMOs are generally the most affordable but require referrals and in-network care. PPOs offer more flexibility but come at a higher cost.

4. Evaluate Bronze and Silver Tier Plans

Bronze plans have lower monthly premiums but higher deductibles, making them suitable for healthy individuals. Silver plans offer moderate premiums with better cost-sharing, especially if you qualify for additional subsidies.

5. Apply for Medicaid or CHIP if Eligible

If your income is below a certain threshold, you may qualify for free or low-cost coverage through Medicaid or the Children’s Health Insurance Program (CHIP). Enrollment is open year-round.

6. Maximize Free Preventive Care

All ACA plans cover preventive services like vaccinations, screenings, and annual checkups at no extra cost. Taking advantage of these can help avoid costly treatments later.

Conclusion

To get the cheapest health insurance plan in your state, start by using the health marketplace, explore available subsidies, and carefully compare coverage levels. By being informed and proactive, you can secure quality healthcare while staying within budget